We may earn a charge whenever you click on a hyperlink or make a purchase order introducing broker forex by means of the hyperlinks on our web site. All of our content material relies on goal evaluation, and the opinions are our personal. Broker-dealers differ from Registered Investment Advisors regarding options, skills and requirements, and expenses.

Chance Of Income From Introducing Brokers

You will also have a private affiliate supervisor to information you on the method to maximize your earnings, in addition to free promotional supplies such as on-demand banners. The Company reserves the proper to request the submission of server log files for IB actions that it considers suspicious. In addition, to guard the safety of the system that operates this service, the Company will not disclose such criteria to IBs in precept, until there are special circumstances. There are several the purpose why Forex buying and selling has become well-liked in recent times. Using your referral actions from a brokerage program can help an IB to start earning money with out investing in any fund. Each option provides flexibility, permitting you to decide on the partnership that works finest for you.

Prime Sites For On-line Casino Dogecoin: A Complete Information

One of the most engaging features of YaMarkets’ affiliate program is its two-tier commission system. This lets you not only earn from merchants you refer immediately but in addition from sub-affiliates you introduce to the program. If these sub-affiliates herald traders, you’ll earn a share of their commissions too, which means additional passive earnings with out further work. The SEC provides a whole set of requirements for all formalities, which can differ from state to state, and the broker-dealer should adhere to them.

Introducing Brokersib / Affiliates

Q Options also runs a “Representative Program” for its multi-asset brokerages. They currently work with numerous Introducing Brokers around the globe. In addition, one of many main components that appeal to them is the high commissions of IB – the share of commissions reaches 45%. Ltd. allows more than 800 world-leading manufacturers to extend international market share, pace adoption of products and successfully interact their clients in local markets worldwide.

The Number One Ib Business Associate

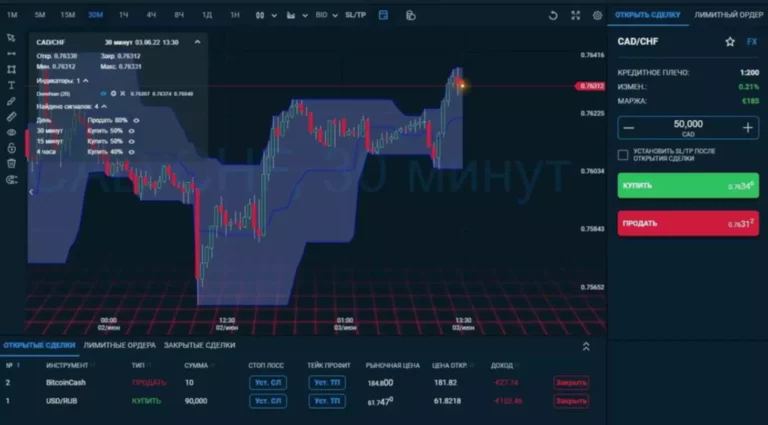

Trading futures also requires margin deposits that may vary from as little as $300 to greater than $7,000 relying on the kind of commodity being traded and the quantity of the contract. An introducing broker is a financial adviser who focuses on futures investing. An investor who is thinking about futures however not inclined to dive in alone would consult with an introducing dealer. The introducing dealer may be employed by an organization that is a partner of the fee merchant’s firm or a direct subsidiary of it. Introducing Brokers is an integral a part of the Forex market, as they provide many promising strategies for newbies and help them navigate the trading platform. We had been surprised how a lot we have been able to earn right away with online buying and selling.

Become A Associate Of Ifc Markets & Earn

Finally, OctaFX’s popularity as a world Forex broker, trusted by over 12 million purchasers worldwide, is an asset to any IB. OctaFX Partners is a part of the reputable OctaFX model, which has earned the public’s belief by winning more than 60 business awards. It is easy for companions to work both in their international locations and enter new areas for the rationale that dealer is already famous within the world market. Investing in the Forex market is increasingly rising and gaining popularity. In such an exciting area as trading, there might be at all times a demand for specialists who get an advantage over much less experienced traders at the start. In this text, we have looked at a gaggle of individuals referred to as Introducing Brokers (IBs), as well as brought you the top 7 Introducing Broker programs to hitch in 2022.

With continued customer referrals, IBs can create a constant stream of passive revenue, mainly if their clients commerce regularly over extended intervals. Since some brokers give as much as 60% of the unfold, IBs can generate sizable month-to-month earnings. When it comes to the difference between a foreign exchange affiliate and an Introducing Broker, many individuals often get confused. A important quantity of particulars regarding referrals are given to Introducing Brokers. Introducing Brokers are required to construct a solid relationship with their prospective customers.

Your Best Trading Expertise Is A Click Away

In different words, “placement agents” aren’t exempt from broker-dealer registration. There is not any intrastate exception from registration for municipal securities sellers or authorities securities brokers and sellers. When placing your cash with a dealer, you should make certain your broker is secure and may endure through good and dangerous times. The quantity of clients’ buying and selling, the broker’s fee schedule, and the introducing broker’s (IB) marketing efforts all affect how a lot cash they make. An IB can compute their potential earnings, for example, if they introduce a shopper that trades ten tons per thirty days at a one-pip spread, and they earn 50% of the spread.

Without any limits, you’re going to get additional 50% p.c of all fee rewards earned by your sub-partners. In a nutshell, the revenue of an Introducing Broker stays a volume-oriented kind of earnings. It is necessary to know that no conflicts of curiosity happen with this type of enterprise partnership. Introducing Brokers may even get a number of innovative instruments that may assist them monitor commissions earned and clients.

- Although they could suggest products for which they may obtain a commission, merchants should nonetheless approve such offers.

- This company‘s affiliate program uses a revenue share model, and so they supply a 50% to 60% income share.

- Additionally, consider if another charges are essential or just within the curiosity of the dealer.

An introducing broker helps with this process by introducing their shoppers to a clearing dealer. For more information read the Characteristics and Risks of Standardized Options, also called the choices disclosure document (ODD). Alternatively, please contact IB Customer Service to obtain a duplicate of the ODD. Before buying and selling, purchasers must learn the related risk disclosure statements on our Warnings and Disclosures web page. Trading on margin is just for experienced buyers with excessive risk tolerance. For further details about rates on margin loans, please see Margin Loan Rates.

A giant share of brokerage companies wish to function Introducing Broker programs as a result of it can decrease the prices required to get new clients. The advertising efforts shall be assigned to folks and firms that are engaged on a commission basis. Some nations require that Introducing Brokers must be approved entities by legislation. For instance, within the United States of America, IBs are anticipated to register with the NFA to do enterprise with US citizens. Introducing brokers in Europe usually are not sure by any regulation or requirement to be regulated, but may cross through an intensive vetting process.

In the immeasurable cosmos of Forex trading, your journey is distinctly your personal, painted along with your aspirations, dangers, and the paths you choose to tread. IBs merely assist in charting a course via the sometimes tumultuous waves, ensuring you’re navigated safely via potential perils and guided in the path of profitable horizons. Stepping into the colossal universe of Forex buying and selling can seem like navigating through a perplexing labyrinth for both novice and seasoned traders alike. With countless pairs fluttering in the huge ocean of buying and selling opportunities, it’s vital to have a reliable compass directing your ventures. This is where Introducing Brokers, or in buying and selling vernacular, “IBs”, turn into the unsung heroes of your Forex journey.

The supplier company can build the software program in accordance with your corporation wants and in exchange, charge an in-advance fee with extra maintenance and repair fees. This web site accommodates information on many merchandise and offerings from associates of Interactive Brokers Group. Interactive Brokers (India) Private Limited offers solely services as permitted underneath the NSE, NSDL and SEBI regulations. Each Advisor, Proprietary Trading STL and Multiple Hedge Fund master account holder can add shopper, sub and hedge fund accounts as required.

YaMarkets is a regulated broker, which implies you’ll find a way to confidently put it up for sale figuring out that purchasers are in secure arms. The platform is thought for its transparency, quick commerce execution, and security, making it a dependable choice for each traders and affiliates. This trust helps you in changing leads into lively traders extra simply, as folks favor working with brokers that have a powerful status.

Read more about https://www.xcritical.in/ here.