Improving your DIO can take some effort, but it’s worth it in the long run. A lower DIO can help you improve your cash flow, profitability, and overall business health. Using the figures from our earlier pharmacy example, the inventory turnover for John’s Pharmacy would be 6.7. This means that the pharmacy replenished its stock just under seven times in one year.

How to use Days Inventory Outstanding in your business

Another factor that can affect DIO is the level of competition in the market. In highly competitive industries, companies may need to maintain higher levels of inventory to ensure they can meet customer demand quickly. This can lead to a higher DIO compared to companies in less competitive industries.

Why Days Inventory Outstanding is Important for Businesses

- A low inventory turnover rate suggests either weak sales or excess inventory.

- If after calculating your days inventory outstanding, you see a need for improvement, there are ways to improve your days inventory outstanding results.

- It may lead to a surge in demand for water purifiers after a certain period, which may benefit the companies if they hold onto inventories.

- Because DIO tracks the movement of inventory, some industries will naturally have higher or lower scores.

- Let’s say that a company has low DIO, meaning it takes a long time to transfer inventory into cash.

However, it’s important to compare DIO with industry benchmarks and historical performance for a more meaningful analysis. Most businesses keep buffer or safety stocks to guard against demand or supply variability. Longer lead times increase the stock-out risk and may affect the amount of safety stock employed. With seasonal sales, you will see a rise and fall in your DIO throughout the year. If your stock is well managed, you should see an increase in DIO just before your busy season and a reduction ahead of the slower period.

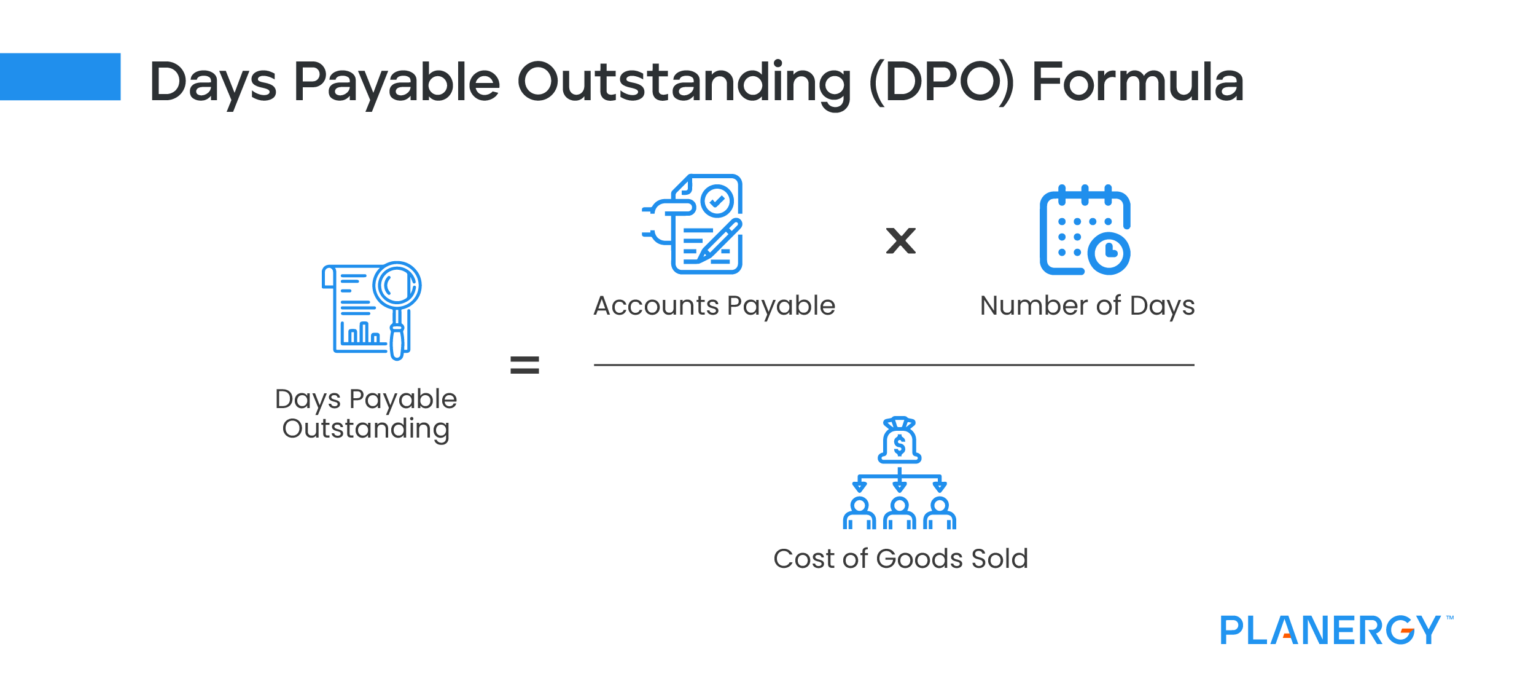

Days Inventory Outstanding Calculation Example

On the other hand, if DIO increases, the days it takes to turn inventory into cash also increases. That means the condition of the company’s working capital will also deteriorate. Let’s say that a company has low DIO, meaning it takes a long time to transfer inventory into cash. That average days inventory outstanding means the days it takes to turn inventory into cash also decreases. First of all, days inventory outstanding (DIO) is a measurement of the company’s performance in terms of inventory management. In the formula, we can see that the inventory is divided by the cost of goods sold.

Below is the list of top companies in the Oil & Gas Sector, along with its Market cap and inventory days outstanding. Below is the list of top companies in Discount Stores and their Market cap and outstanding inventory days. Below is the list of top companies in the Automobile Sector, along with its Market cap and inventory days outstanding.

In order to efficiently manage inventories and balance idle stock with being understocked, many experts agree that a good DSI is somewhere between 30 and 60 days. This, of course, will vary by industry, company size, and other factors. For SMBs looking to improve the control they have over cash flow, getting on top of days inventory outstanding is a great start. By focusing on timely and consistent delivery of materials and suppliers, you can avoid bottlenecks and delays, shortening the time it takes to turn raw inventory into sellable products. Days inventory outstanding is just one component of a broader framework and set of metrics used to measure the efficiency of an organization’s working capital management. If you’re like many business leaders, you probably don’t have a clear answer to this question.

Profitability is directly related to the ability to sell products, so it stands to reason that your DIO will directly impact profitability and your company’s cash balance. However, that inventory does not accurately reflect your average inventory for that time period, since you’ll likely not order the same amount of inventory regularly. For example, if the industry average is 50 days and your company’s DIO is 40, you’re performing better than your competitors. Only compare your days inventory outstanding results with similar companies and not across multiple industries.

Several factors can influence a company’s DIO, including the nature of the industry, the product mix, the seasonality of sales, and the efficiency of the supply chain. Different goods require varying lead times, which ultimately affects the DIO. Additionally, product-specific promotions, customer demand, and production schedules can all impact the inventory turnover rate and, therefore, the DIO. Days Inventory Outstanding (DIO) indicates the level of inventory management efficiency. A high DIO suggests that a company may have too much inventory and we know excess inventory is costly, raising inventory holding costs.

This calculation results in a figure that reveals proportionally how long it takes for a business to sell its inventory. If the COGS and average inventory are closer in value, the resulting calculation will be a smaller number, closer to the number of one. It is important to note that DIO varies by market, industry, and business.

Managing inventory levels is vital for most businesses, and it is especially important for retail companies or those selling physical goods. As a critical component of inventory management, Days Inventory Outstanding (DIO) refers to the average number of days a business takes to turn its inventory into sales. In simpler terms, DIO indicates how quickly a company sells its inventory and measures the efficiency of its inventory management system. The lower the DIO, the faster a company can sell its inventory and generate revenue. Measuring DIO is an essential part of inventory management because it helps businesses optimize their inventory levels, minimize unnecessary inventory costs, and maximize revenue. DIO not only provides insight into the efficiency of a company’s inventory management system, but it also indicates the effectiveness of its sales and marketing strategies.