Debits are used to increase expense accounts, such as rent expense, reflecting the outflow of funds from the company. Bad debts can be written off when it has been determined that a customer is unable or unwilling to pay their outstanding balance. This decision is made after rigorous efforts have been made to collect the debt, such as sending multiple notices and making collection calls. By writing off the bad debt, the company recognizes the loss and adjusts its financial statements accordingly. It is actually an expense incurred by a business to occupy space for its operations.

Debits and Credits

The provision for doubtful debts is a contra asset account related to debtors. Nowadays, with the development of a computerized accounting system, it is easy and quick to prepare the contra asset accounts as the system does all the calculations, and hardly anything is pushed manually. However, where do contra assets go on a balance sheet an accountant or person in charge must ensure that any change in the value of the assets due to revaluation or impairment must be considered. With increasing globalization and companies operating in many countries, the books of accounts must be compatible with a global platform.

Accumulated Depreciation and Depreciation Expense: A Complete Guide

It also helps create reserves, and later any change in the expected number can be adjusted through allowances and reserves. In other words, contra revenue is a deduction from gross revenue, which results in net revenue. In footnote 3, the company reports, “Net property and equipment includes accumulated depreciation and amortization of $25.3 billion as of August 1, 2021 and $24.1 billion as of January 31, 2021.” Whether reported as separate lines on the financial report or as a cumulative value, the net amount of the pair of accounts is called the “net book value” of the individual asset. When the two balances are offset against each other they show the net balance of both accounts. At H&CO, our experienced team of tax professionals understands the complexities of income tax preparation and is dedicated to guiding you through the process.

Types of Contra Asset Accounts

He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

The direct write-off method delays recognitionof bad debt until the specific customer accounts receivable isidentified. Once this account is identified as uncollectible, thecompany will record a reduction to the customer’s accountsreceivable and an increase to bad debt expense for the exact amountuncollectible. The company can recover the account by reversing the entry above to reinstate the accounts receivable balance and the corresponding allowance for the doubtful account balance. Then, the company will record a debit to cash and credit to accounts receivable when the payment is collected. You’ll notice that because of this, the allowance for doubtful accounts increases. A company can further adjust the balance by following the entry under the “Adjusting the Allowance” section above.

- In the financial statements the asset a/c would be offset against the contra asset a/c to show the net balance.

- If it does not issue credit sales, requires collateral, or only uses the highest credit customers, the company may not need to estimate uncollectability.

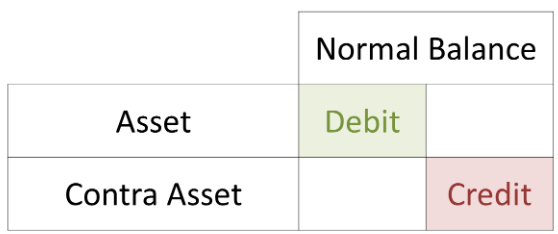

- A contra asset is a negative asset account that offsets the asset account with which it is paired.

- Accountants use contra accounts rather than reduce the value of the original account directly to keep financial accounting records clean.

The calculated bad debts expense affects the income statement by recognizing an expense related to receivables that are unlikely to be collected. Concurrently, an allowance for doubtful accounts is established or adjusted, which is a contra-asset account that offsets the accounts receivable balance on the balance sheet. Contra revenue is a general ledger account with a debit balance that reduces the normal credit balance of a standard revenue account to present the net value of sales generated by a business on its income statement. Examples of revenue contra accounts are Sales Discounts, Returns and Allowances.

Accumulated depreciation refers to the cumulative depreciation expense recorded for an asset on a company’s balance sheet. It is determined by adding up the depreciation expense amounts for each year. On a more granular level, the fundamentals of financial accounting can shed light on the performance of individual departments, teams, and projects. Whether you’re looking to understand your company’s balance sheet or create one yourself, the information you’ll glean from doing so can help you make better business decisions in the long run. The allowance method is the more widely used method because itsatisfies the matching principle. The allowancemethodestimates bad debt during a period, based oncertain computational approaches.

However, the actual payment behavior of customers may differ substantially from the estimate. It is actually a liability account that represents the amount owed by a company to its employees for work performed but not yet paid. Wages payable is typically recorded as a current liability on the balance sheet. A contra account in accounting is an account that offsets the value of another related account.

Note that accountants use contra accounts rather than reduce the value of the original account directly to keep financial accounting records clean. If the bond is sold at a discount, the company will record the cash received from the bond sale as “cash”, and will offset the discount in the contra liability account. However, a potential interpretation could refer to an account that offsets the value of accounts receivable. This could include allowances for doubtful accounts or contra-assets related to receivables. It’s important to analyze the specific context or term used to provide a more accurate explanation.

Then, current and fixed assets are subtotaled and finally totaled together. Bad Debt Expense increases (debit), and Allowance for DoubtfulAccounts increases (credit) for $48,727.50 ($324,850 × 15%). Thismeans that BWW believes $48,727.50 will be uncollectible debt.Let’s consider that BWW had a $23,000 credit balance from theprevious period. At the end of an accounting period, the Allowance for DoubtfulAccounts reduces the Accounts Receivable to produce Net AccountsReceivable. Note that allowance for doubtful accounts reduces theoverall accounts receivable account, not a specific accountsreceivable assigned to a customer. Because it is an estimation, itmeans the exact account that is (or will become) uncollectible isnot yet known.